What does being intentional with money actually mean?

Overview

In this article I touch on our current capitalistic financial landscape and look at the effects of financial influencers, what living intentionally is and what it isn’t, why minimalism and ADHD work well together, and how to reduce impulse decision-making.

Financial complexity

Currently, our financial industry is complex (to put it mildly). The reason being, that the more complex it is, the easier it is for big companies, financial advisors, and con artists to sell investment products, scam consumers, and take advantage of our lack of knowledge. Of course, not all people trying to help are like this, but unfortunately, there are a lot out there who are.

For instance, if you want to know more about one of your 401(k) investments, you often have to download a “prospectus” that can be anywhere from 50 to 200+ pages long! Just for one investment. This needless complexity negatively affects many, (especially those with ADHD) creating more reasons to feel overwhelmed, guilty, or ashamed.

Our current financial system

Aspects of our current society like hyper-consumption, marketing oversaturation, and profit-first companies have all contributed to an environment of toxic productivity, excess, and ambition over anything. Minimalism and the increasing popularity of financial independence, retiring early, and quiet quitting are all responses to our broken system.

Thankfully, our government is starting to increase regulation in more industries. Unions are getting their members what they deserve, and our society is starting to see through the façade big businesses have been trying to maintain.

Financial influencers

Too many financial influencers online are sharing misinformation, motivated primarily by increasing their followers, selling their products, or outright trying to scam you.

Not only that, but these influencers say you should:

- Get this product

- Open this account

- Save for this

- Don’t buy that

- Live like this

These are their biased opinions. If we take these as facts to live by, it can create a toxic mentality of, “If I don’t do this or I don’t know about that, then I’m not doing what I should with my finances,” and anxiety soon follows.

Of course, there is good advice online, but even if the advice is helpful, it can lead you down a path that isn’t right for you.

Following others' advice

This happened to me before I went to college for finance and got into financial planning. I read dozens of finance books, watched hundreds of hours of informational videos, and read countless articles to try and educate myself on money. They all seemed to talk about the same things: how the best ways to succeed financially were to be financially independent, and frugal, invest in real estate, and save 50% or more of your income.

I went after those goals and achieved some of them but woke up one day unhappy. Money had become all-encompassing and my self-confidence was wrapped up entirely in how I used money. All the advice I read and took to heart was nested in the mentality that "if you don't live like this, you aren't good with money". It was toxic, and I have been working on releasing this baggage ever since.

The advice of others (yes, even my advice) should be critically evaluated. Don’t take everything someone says as the truth and copy and paste it into your own life. Examine their advice and pick and choose, applying pieces of it where they fit into your life and make sense for your goals. Fact-checking advice in general before doing something complex, like investing, is a good habit to get into.

The Integration of Minimalism and ADHD

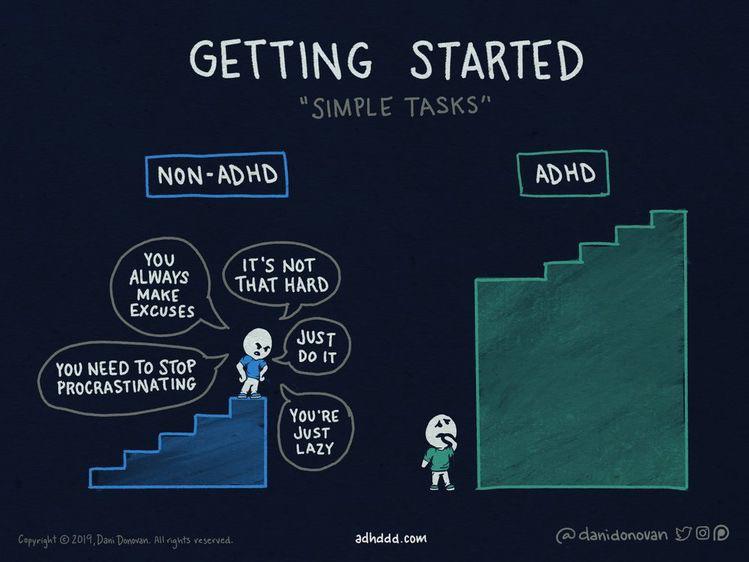

Managing money while having ADHD can be especially daunting. Taking the first “step” towards educating ourselves is more of a great big leap. There will be struggles along the journey and introspection that can be hard to go through, but it is worth it!

Minimalism can help you understand what matters in your life through self-exploration, providing insight into your values, and removing things from your life and routines that overwhelm you and make you feel guilty.

Living intentionally, simply, and using your resources for things that matter are all parts of minimalism that I believe align with both money and ADHD.

What does it mean to live more intentionally?

“Intentional” is defined as “done on purpose, deliberate”. The simplest explanation of being intentional is to think about your decisions before you make them.

Living intentionally doesn't mean anti-consumerist

It means thoughtful consumption. Using minimalism as a way to approach your life can reduce overall consumption, but it isn't about going to extremes for the sake of it. Being "anti-consumerist" is impossible. Every living thing on this planet consumes. Humans consume air, water, food, products, gas, energy, housing, cars, etc. Without these things, we couldn't operate in modern society. Being anti-consumerist is an unrealistic expectation, one that can increase guilt and shame if you aren't spending time trying to succeed at it.

Living intentionally doesn't mean zero-waste

It's more about reducing what we can. Trying to be zero waste is also impossible and would require an incredible amount of work, patience, and discipline. I'm not saying you shouldn’t be thrifty, or fix your broken things rather than buy new all the time. These are great and can help to lower your waste, but it is next to impossible to create zero waste in today’s society.

How to live more intentionally

It can be hard to spend money intentionally when it comes to things that you care about or that excite you. When you find something you want to buy, a dopamine response in your brain gets triggered that keeps you focused on it until you take action. Here are some tips to help reduce impulse buying:

create a "cooling off" period

If you find something you really want, try to wait one day before you purchase it. Waiting even one day can help you limit impulse buying because it removes the immediate emotional trigger that makes you want to buy something right now. After you’ve “cooled off” from the initial excitement, you may realize you don’t really need that item after all.

make decisions on your good days

Find a day, or a time of day, when you feel the most clear-headed. This should be when you analyze a purchase decision or make purchases that you have been holding off on. Waiting until you are calm and clear-headed to make decisions prevents impulse buying in times when you’re overwhelmed or tired and just want to get one task off your to-do list.

know the return policy

Know the return policy of anything you purchase and put it on your calendar. As the date approaches, check in with yourself to see if that purchase still serves you or if you can return it.

With this approach, you can buy things quickly (fulfilling that dopamine rush), but it doesn’t affect your finances as long as you return the item. This tactic should only be used when you are hyper-focusing and can’t get the purchase off your mind.

Closing Thoughts

Living intentionally, thinking through your purchases, and creating a personal world that matches who you are and who you want to be are worth doing. But it may be harder for some than others. For instance, those of us with ADHD must purposefully put barriers in place to stop our impulse buying.

On this journey to improve your financial well-being, remember to be open to learning new methods and tactics, but don’t copy and paste what one person says directly into your own life. Evaluate their advice and see where it may work well in your life and which parts don’t make sense for your goals.

Think progress, not perfection. You don’t need to know everything to get started, but you do need to feel good about what you’re doing or else it won’t last. As you implement anything, check in with yourself and ask, “Does this make me feel good?” If it doesn’t, take a step back and reevaluate your approach.